In the place of a normal financing, each Government Homes Government mortgage are insured because of the FHA

An FHA mortgage was designed to simplicity the way to help you homeownership for those who may well not meet with the stricter requirements from a beneficial antique mortgagepared so you’re able to a conventional mortgage, FHA loan monetary requirements tend to be more everyday. However, property official certification are usually stricter, FHA vs old-fashioned mortgage.

Information Ahead

I. Credit rating II. Debt-to-Earnings (DTI) III. Downpayment IV. Interest V. Financial Insurance coverage (MIP) VI. Loan Maximum VII. Property Criteria VIII. Bankruptcy proceeding IX. Refinancing

Provided for informative objectives simply and you can subject to change. These show popular eligibly standards across the industry for old-fashioned and FHA fund. Good Home loan qualification requirements can differ. Get in touch with financing officer to discuss.

We. Credit rating

Getting an enthusiastic FHA mortgage, a minimum credit history out-of 580 tends to be required to qualify into minimal 3.5% deposit. An excellent step 3.5% deposit compatible a good 96.5% loan to help you well worth (LTV) ratio. A keen LTV proportion was a fact (indicated while the a portion) you to definitely signifies the mortgage number compared to the appraised worth of the house.

A credit rating between five hundred and you may 579 may also be accepted?, nevertheless restrict LTV would-be ninety%, which means that brand new down payment must be at the very least 10% of appraised worth.

Individuals with a credit history of less than five-hundred doesn’t typically be eligible for an FHA financial. At the same time, at least credit rating of 620 are had a need to qualify having a traditional financing mortgage. If you are minimal standards can differ from the bank, credit rating could possibly get prove to be a key differentiator for the choosing which is more appropriate, FHA vs old-fashioned mortgage.

The financing score dependence on a traditional mortgage may be large due to the fact lender plays a great deal more risk. A traditional financing lacks the us government guarantee out of a keen FHA financing.

If the credit rating is in the can i use balance transfer to pay off loan low so you can middle-600s, an FHA mortgage tends to be a better option for you.

II. Debt-to-Money (DTI) Ratio

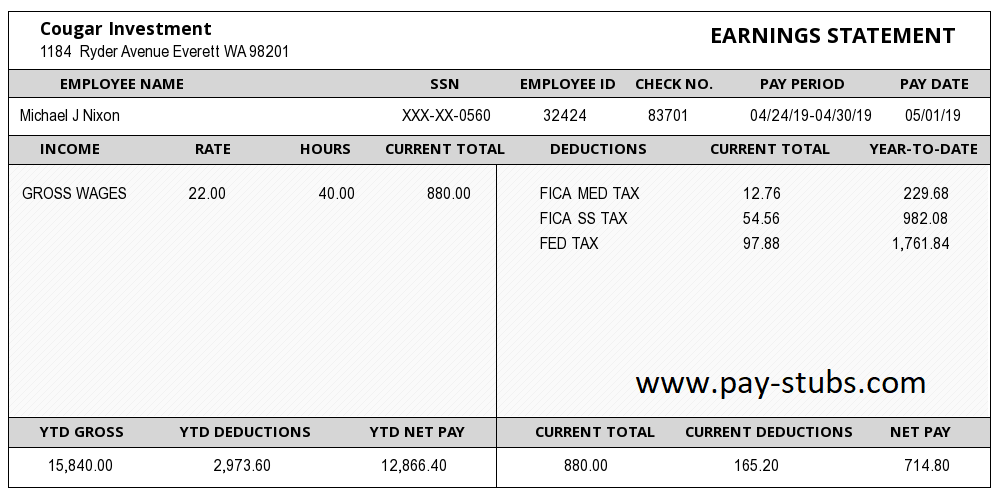

FHA restrictions the level of personal debt a borrower have inside the relation to the monthly money. So you’re able to estimate DTI, separate their total monthly bills by your disgusting (pre-tax) monthly earnings. There are 2 kind of DTI percentages FHA explores:

- Front-end proportion, and this just talks about casing-relevant expenditures

- Back-end ratio, and therefore investigates overall financial obligation and can include automobile financing, playing cards, and you may student loans

The newest max FHA DTI ratio was 31% to have property relevant financial obligation and you can 43% getting overall debt. Although the most readily useful DTI was 43% to have conventional mortgage loans, discover cases where the fresh new DTI is also due to the fact highest while the 50%.

Strong Home loan get increase DTI on the FHA funds to fifty% having high credit scores, most home loan supplies, and other compensating items. Pose a question to your mortgage officer when you have questions regarding the DTI standards, FHA compared to traditional loan.

III. Downpayment

Most people imagine a good 20% downpayment needs to own a traditional mortgage. Although not, a normal mortgage means a somewhat all the way down lowest down-payment regarding 3% than the lowest deposit requisite on the a keen FHA mortgage (step 3.5%).

Off repayments should be financed out of opportunities, bank accounts, and gifts. That is true both for home loan types in addition to FHA and you can traditional funds. Each other mortgage designs along with succeed one hundred% of the downpayment in the future regarding provide funds. not, with regards to gifting funds, there are many trick differences when considering these two financing models.

This new accepted current money present tend to be wider for an FHA mortgage. To have a compliant traditional financing, brand new current need certainly to come from a close relative. FHA makes it possible for gift ideas regarding loved ones, family, labor unions, and you will companies. Based on HUD, members of the family also can provide FHA borrowers guarantee credit due to the fact a gift on property being sold to many other members of the family.

Leave a Reply